One of the most crucial things you can do on the way towards being financially free is to keep up with your spending. It doesn’t matter whether you are earning your first wages or have several income flows, having an idea of where each dollar (or rupee or pound or euro) can be invested will allow you to spend your money wiser, save more, and eliminate extra stress factors.

Luckily, you do not have to work with complex spreadsheets and costly software. By 2026, there are an abundance of free money-tracking tools that will automatically track your spending, classify it, and even connect with your bank accounts.

We are going to discuss the most useful free applications to follow your expenditures, all selected by Gen Z people who need to understand their money and have the ability to spend it better.

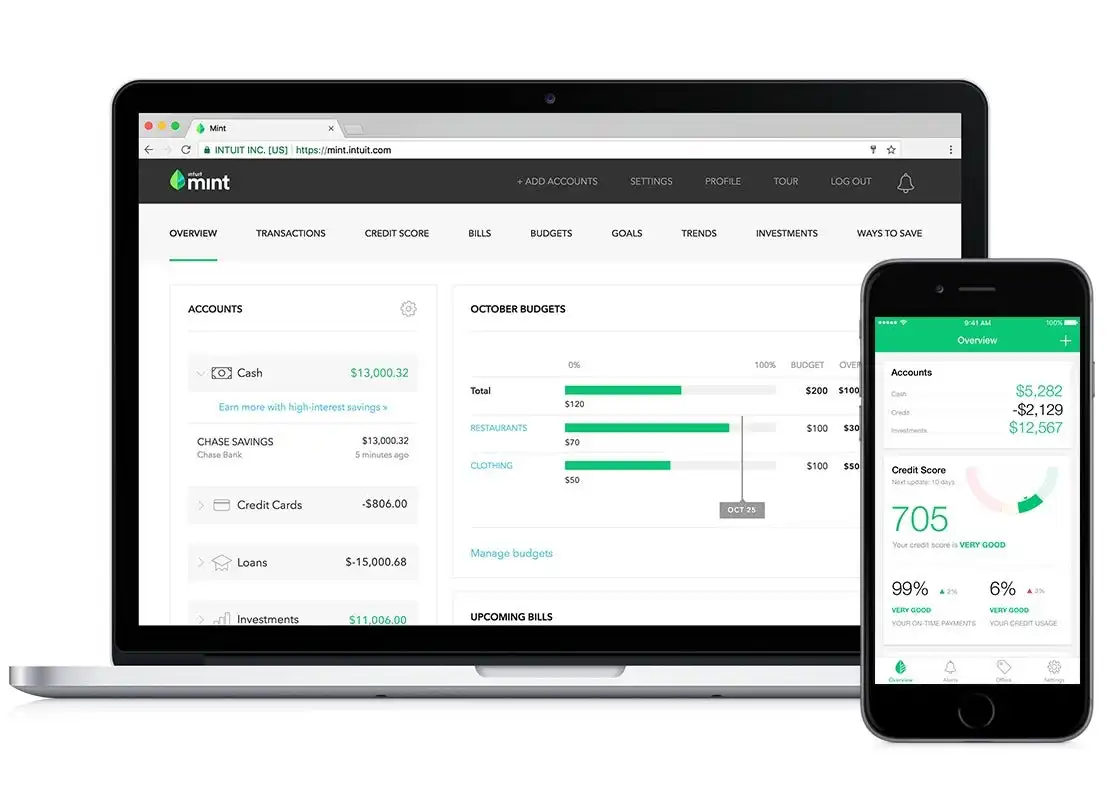

1. Mint (by Intuit)

Best for: Beginners and budget planners

Mint is among the most used free apps of managing personal expenses. It links safely to your accounts, credit cards to provide you with real time information about your money.

Key Features:

- Automatic classification of expenses.

- Reminder of bills and credit score.

- Visual graphs and spending insights

- Goal tracking (like saving for travel or an emergency fund)

💰 Currency support: Primarily USD ($), but also works in other regions with custom categories for INR, GBP, and EUR.

📱 Platform: Android, iOS, and Web

2. PocketGuard

Best for: People who overspend easily

PocketGuard will notify you of how much money you can spend reasonably after considering bills, goals and needs. It is ideal when you always ask yourself, is it something I can afford before making a purchase.

Key Features:

- “In My Pocket” feature for real-time spending limits

- Links to bank accounts automatically

- Budgeting and bill tracking tools

- Data encryption for secure tracking

💰 Currency support: USD ($), with conversion options for GBP £, and EUR €

📱 Platform: iOS, Android

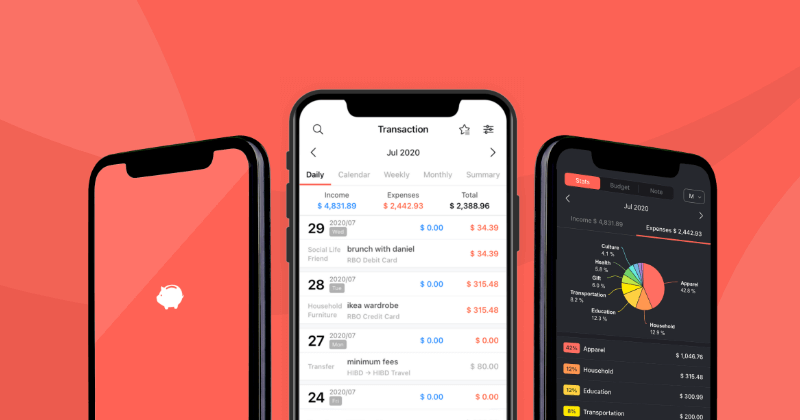

3. Money Manager Expense & Budget (by Realbyte)

Best for: Visual spend trackers and cash users

It is among the most popular apps in Asia and can work with several currencies such as INR ₹, USD $, and EUR €. It is best when the person likes to manually enter expenses but has the desire to have automatic summaries and charts.

Key Features:

- Manual and auto-entry support

- Graph-based visualization

- Asset management (cash, card, savings)

- Daily, weekly, and monthly reports

📱 Platform: Android, iOS

4. Goodbudget

Best for: Envelope budgeting method fans

Goodbudget takes the old envelope system of budgeting and makes it digital, just like usual you put money in envelopes (categories) and you can only spend what is in an envelope.

Key Features:

- Sync across multiple devices

- Cloud storage for your budgets

- Great for couples or families sharing expenses

- Manual entry (no direct bank sync, keeping it privacy-friendly)

💰 Currency support: Global currencies including USD, GBP, INR, and EUR

📱 Platform: iOS, Android, Web

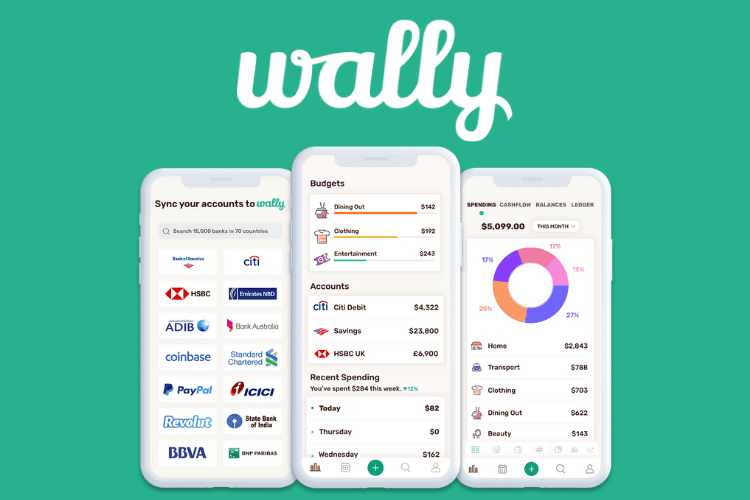

5. Wally

Best for: Expense insights and multi-currency support

Wally is a global hit which accepts dozens of currencies and even resorts to automatic monitoring of the foreign exchange. This is ideal with freelancers, travelers or digital nomads who need to keep track of their costs in different currencies.

Key Features:

- AI-powered expense insights

- Multi-currency support (USD $, INR ₹, GBP £, EUR €)

- Receipt scanning and smart categorization

- Syncs across multiple devices

📱 Platform: Android, iOS

6. Spendee

Best for: Shared family or friend budgets

You can use Spendee to form group wallets with friends or family, thus it is best suited to group trips, relationships, or shared dormitories. The free version has superior personal expense tracking features.

Key Features:

- Shared wallets for groups

- Budget planning by category

- Beautiful visual interface

- Bank sync in premium, manual tracking in free version

💰 Currency support: USD $, INR ₹, GBP £, EUR €

📱 Platform: Android, iOS, Web

7. Axio (India-Specific Pick)

Best for: Indian users tracking expenses via SMS

The Walnut money manager app is now Axio and is a free, automated expense tracking and personal finance app that analyzes SMS messages from banks to log transactions.

Key Features:

- Automatic SMS-based expense tracking

- Bill reminders and split options

- Secure, offline functionality

- Multi-language support

💰 Currency: INR ₹

📱 Platform: Android, iOS

Bonus: Google Sheets + Tiller Template (DIY Tracker)

Best for: Spreadsheet lovers and customization

If you love control and want to design your own spending dashboard, Google Sheets + Tiller Money templates can be a powerful combo. You can set it up free with manual entry or link your accounts for automation (paid).

Key Features:

- 100% customizable

- Visual dashboards and monthly insights

- Google Drive integration

- Great for freelancers or personal finance creators

📱 Platform: Web, Mobile via Google Sheets

Quick Comparison Table

| Tool | Best For | Currency Support | Auto Sync | Platform | Free Plan |

|---|---|---|---|---|---|

| Mint | Beginners | USD, INR, GBP, EUR | ✅ | iOS, Android, Web | ✅ |

| PocketGuard | Overspenders | USD, GBP, EUR | ✅ | iOS, Android | ✅ |

| Money Manager | Visual users | USD, INR, EUR | ⚙️ Optional | iOS, Android | ✅ |

| Goodbudget | Envelope budgeting | USD, INR, GBP, EUR | ❌ | iOS, Android, Web | ✅ |

| Wally | Travelers | USD, INR, GBP, EUR | ✅ | iOS, Android | ✅ |

| Spendee | Shared budgets | USD, INR, GBP, EUR | ⚙️ Limited | iOS, Android, Web | ✅ |

| Axio (Ex- Walnut) | India-specific | INR | ✅ | iOS, Android | ✅ |

Tips for Choosing the Right Spending Tracker

- Define your goal: Are you saving, debt-tracking, or reducing overspending?

- Check compatibility: Make sure it supports your bank and currency.

- Prioritize automation: Choose apps that auto-sync to save time.

- Review privacy policies: Always confirm the app uses secure encryption.

Frequently Asked Questions (FAQ)

1. What is the best free app to track spending in 2026?

In 2026, Mint is the best free app to use in terms of tracking spending because it has automation, synchronization with the bank, and spending insights.

2. Which app helps track expenses in multiple currencies?

Wally is most suitable in tracking multiple currencies, which suits users dealing with USD, INR, GBP or EUR at a given time.

3. Are free expense tracker apps safe to use?

Yes. The financial data is securely encrypted using bank-level encryption by reputable applications such as Mint, PocketGuard, and Walnut.

4. What’s the best spending tracker for beginners?

Goodbudget or Mint are good places to start with because they are simple and have easy to use dashboards.

5. Can I track my expenses without linking my bank account?

Yes. Manual entry can be made using apps such as Goodbudget, Money Manager and Walnut and you have the freedom to enjoy total privacy.

Final Thoughts

It does not need to be complex to keep track of your spending. No matter what you are trying to save (100 dollars), create an emergency fund, or even looking to explore the world, financial consciousness is easy, visual and fun with these free tools.

It is always advisable to start small and be consistent, and use your favorite expense tracker application that will make every dollar (or rupee, pound, euro) count.